SMART TRADERS TEAM

New York · London · Amsterdam · Lugano · Toronto

New York · London · Amsterdam

Lugano · Toronto

THE DREAM TEAM

We are a team of smart traders

with turnover over $400 million per month, high profitability. Our ROI over 40% per year.

We are a team of smart traders

with turnover over $400 million per month, high profitability. Our ROI over 40% per year.

Co-founder & AI Strategy Lead

Co-founder & Vice CEO

ABOUT

Why Choose Us?

Why Choose Us?

Everything you need to automate, optimize, and scale

The whole world

8 languages, all continents, over 20 countries, 10 currencies

The whole world

8 languages, all continents, over 20 countries, 10 currencies

Science and technology

We leverage our strengths with ai and mathematical modeling

Science and technology

We leverage our strengths with ai and mathematical modeling

Science and technology

We leverage our strengths with ai and mathematical modeling

Skills and abilities

Our advantage is the experience and the desire to explore

Skills and abilities

Our advantage is the experience and the desire to explore

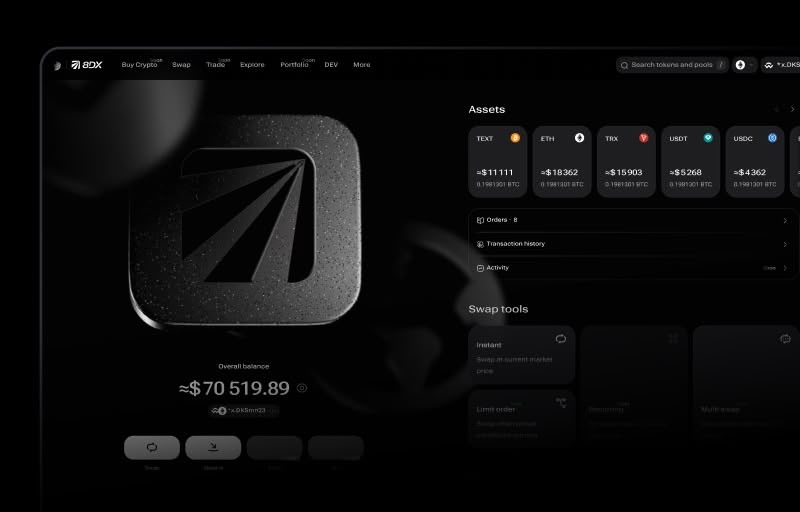

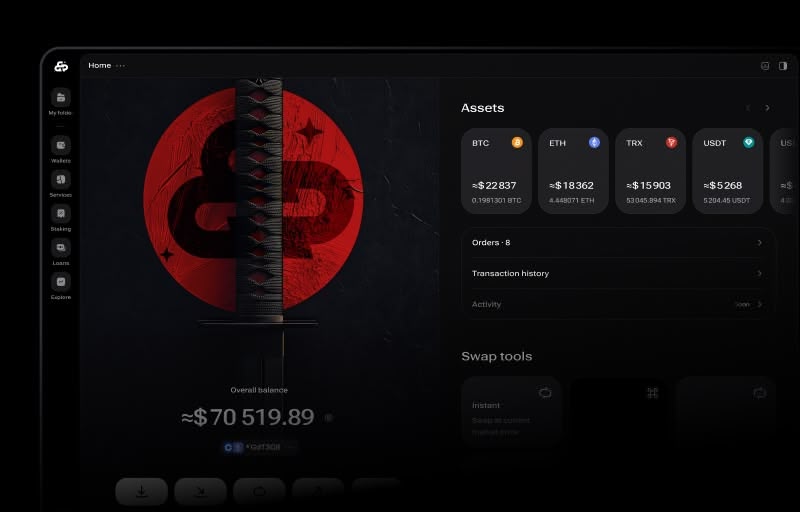

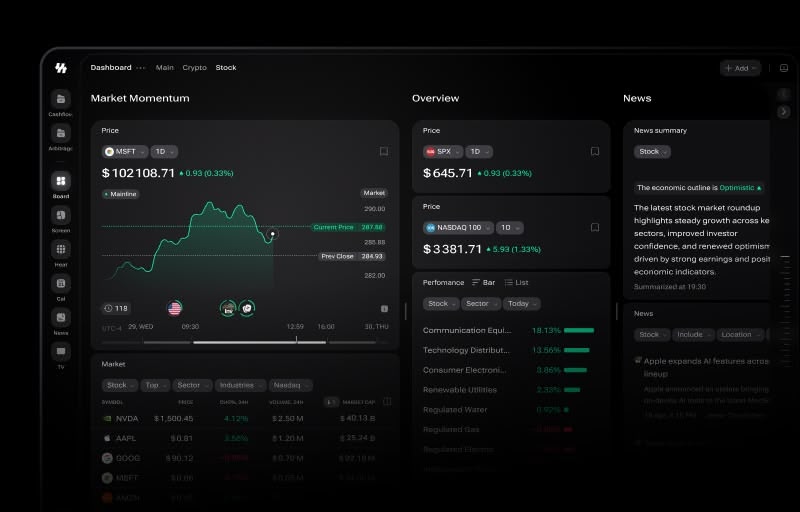

TECHNOLOGY

Profit, Powered by Technology

Profit, Powered by Technology

A quant-driven and AI-powered infrastructure

CFDs and Forex

Futures & commodities

Index & ETFs

Stocks & Bonds

Execution & Smart Routing

Low-latency execution with venue-smart order routing

CFDs and Forex

Futures & commodities

Index & ETFs

Stocks & Bonds

Execution & Smart Routing

Low-latency execution with venue-smart order routing

CFDs and Forex

Futures & commodities

Index & ETFs

Stocks & Bonds

Execution & Smart Routing

Low-latency execution with venue-smart order routing

Real-Time Risk & Portfolio Control

Live limits, exposure monitoring, and automated safeguards

Real-Time Risk & Portfolio Control

Live limits, exposure monitoring, and automated safeguards

Real-Time Risk & Portfolio Control

Live limits, exposure monitoring, and automated safeguards

Quant Research...

Research

Strategy research & validation

Realistic costs & slippage

Regime-aware evaluation

Quant Research & Backtesting

Robust backtests with realistic costs and slippage

Quant Research...

Research

Strategy research & validation

Realistic costs & slippage

Regime-aware evaluation

Quant Research & Backtesting

Robust backtests with realistic costs and slippage

Quant Research...

Research

Strategy research & validation

Realistic costs & slippage

Regime-aware evaluation

Quant Research & Backtesting

Robust backtests with realistic costs and slippage

Code

1

2

3

4

5

AI Signals & Regime Detection

ML filters signals and adapts to changing regimes

Code

1

2

3

4

5

AI Signals & Regime Detection

ML filters signals and adapts to changing regimes

Code

1

2

3

4

5

AI Signals & Regime Detection

ML filters signals and adapts to changing regimes

Market & On-Chain Data

One normalized data layer for TradFi + crypto (CEX/DEX + on-chain)

Market & On-Chain Data

One normalized data layer for TradFi + crypto (CEX/DEX + on-chain)

Market & On-Chain Data

One normalized data layer for TradFi + crypto (CEX/DEX + on-chain)

SOLUTIONS

All features in one place

Everything you need to automate operations, boost productivity

Multi-Asset Toolkit

Futures, commodities, CFDs & Forex, ETFs and index funds, stocks, bonds, and annuities—diversified instruments, one approach

Multi-Asset Toolkit

Futures, commodities, CFDs & Forex, ETFs and index funds, stocks, bonds, and annuities—diversified instruments, one approach

Multi-Asset Toolkit

Futures, commodities, CFDs & Forex, ETFs and index funds, stocks, bonds, and annuities—diversified instruments, one approach

Adaptive Alpha Engine

We continuously test, retrain, and refine strategy logic as market regimes shift—turning change into edge

Adaptive Alpha Engine

We continuously test, retrain, and refine strategy logic as market regimes shift—turning change into edge

Adaptive Alpha Engine

We continuously test, retrain, and refine strategy logic as market regimes shift—turning change into edge

AI + Mathematical Modeling

We amplify decision-making with AI and quantitative modeling to explore and systematize the unknown

AI + Mathematical Modeling

We amplify decision-making with AI and quantitative modeling to explore and systematize the unknown

AI + Mathematical Modeling

We amplify decision-making with AI and quantitative modeling to explore and systematize the unknown

Liquidity & Execution Focus

We prioritize liquid markets and precise execution to keep decisions clean and results repeatable

Liquidity & Execution Focus

We prioritize liquid markets and precise execution to keep decisions clean and results repeatable

Liquidity & Execution Focus

We prioritize liquid markets and precise execution to keep decisions clean and results repeatable

Institutional-Grade Infrastructure

A resilient, low-latency stack for research, execution, and monitoring—built to scale and stay stable under pressure

Institutional-Grade Infrastructure

A resilient, low-latency stack for research, execution, and monitoring—built to scale and stay stable under pressure

Institutional-Grade Infrastructure

A resilient, low-latency stack for research, execution, and monitoring—built to scale and stay stable under pressure

Risk-First Discipline

We treat risk management as the core product—protecting capital while pursuing scalable returns

Risk-First Discipline

We treat risk management as the core product—protecting capital while pursuing scalable returns

Risk-First Discipline

We treat risk management as the core product—protecting capital while pursuing scalable returns

PROCESS

Our Simple & Smart Process

Our Simple & Smart Process

Everything you need to collaborate, create, and scale, all in one place.

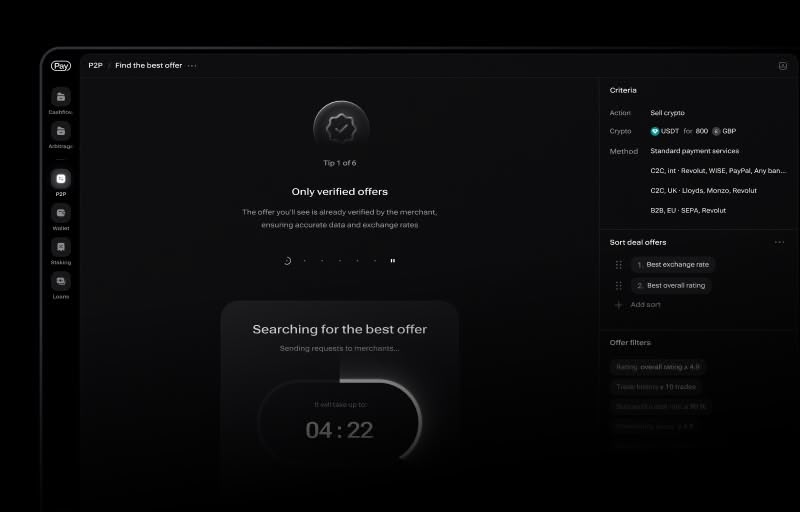

STEP 1

STEP 2

STEP 3

01

Best execution for DEx

We use our own DEX aggregation engine to access deeper liquidity across leading DEXs. Our solutions are designed to deliver an effective execution price and reliable fills—rather than just an attractive headline quote.

STEP 1

STEP 2

STEP 3

01

Best execution for DEx

We use our own DEX aggregation engine to access deeper liquidity across leading DEXs. Our solutions are designed to deliver an effective execution price and reliable fills—rather than just an attractive headline quote.

STEP 1

STEP 2

STEP 3

01

Best execution for DEx

We use our own DEX aggregation engine to access deeper liquidity across leading DEXs. Our solutions are designed to deliver an effective execution price and reliable fills—rather than just an attractive headline quote.

PROJECTS

All features in one place

All features in one place

All features in one place

Everything you need to automate operations, boost productivity

BNG Coin

Built for today

designed for the future

BNG connects multiple crypto services into one economy

A utility crypto token built on Ethereum, designed to support real products,

reduce costs, and grow

A utility crypto token built on Ethereum,

designed to support real products,

reduce costs, and grow

COMPARISON

Why Choose Us Over Others

Why Choose Us Over Others

See how we compare against others in performance

Dream Team Culture

We do the best work in life with the best people in the world.

Our experts collaborate to deliver the best results for you

Our trusted partners

ECash Investment & Forus Capital

Dream Team Culture

We do the best work in life with the best people in the world.

Our experts collaborate to deliver the best results for you

Our trusted partners

ECash Investment & Forus Capital

Dream Team Culture

We do the best work in life with the best people in the world.

Our experts collaborate to deliver the best results for you

Our trusted partners

ECash Investment & Forus Capital